Introduction

In a major breakthrough against organised cyber crime, Delhi Police has dismantled a sophisticated cyber fraud syndicate that allegedly laundered nearly ₹180 crore through a network of shell companies and mule bank accounts. The operation underscores the growing scale and complexity of financial cyber crimes in India.

Background and Context

The crackdown was executed under Operation Cy-Hawk, a special initiative aimed at targeting structured cyber fraud ecosystems and disrupting illicit financial channels used to move stolen funds. The operation focused on tracing money trails rather than isolated fraud complaints, enabling investigators to uncover a much larger network.

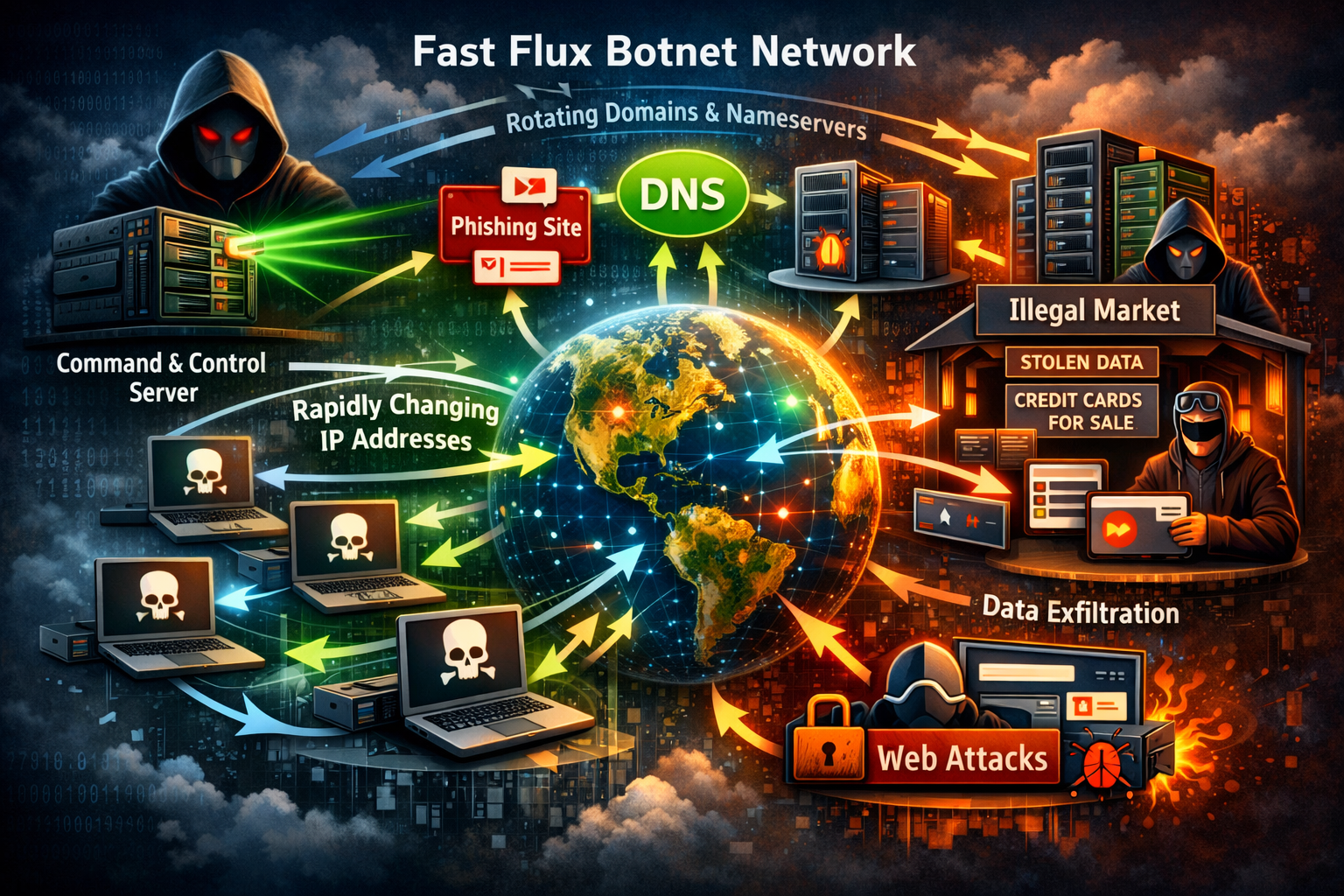

Technical and Financial Modus Operandi

According to the Cyber Police Station of the New Delhi district, investigators identified multiple mule accounts and shell entities allegedly created to launder proceeds of cyber fraud. A key bank account, repeatedly flagged through complaints on the National Cyber Crime Reporting Portal, was registered in the name of M/s Kudremukh Trading (OPC) Private Limited, operating from Connaught Place.

The account displayed classic indicators of a mule account, including high transaction velocity, fragmented transfers, and links to multiple fraud complaints originating from different states.

Timeline of Events

- November 19, 2025: An FIR was registered under relevant provisions of the Bharatiya Nyaya Sanhita after preliminary financial intelligence linked the account to organised cyber fraud.

- Subsequent Investigation: Authorities uncovered that the company account was opened in the name of Rajesh Khanna, who later disclosed that he acted on instructions from Sushil Chawla and Rajesh Kumar Sharma.

- Arrests: After initially cooperating, the accused evaded police notices and were later arrested following sustained surveillance and evidence collection.

Network Scale and Links

Investigators revealed that the accused allegedly controlled and operated at least 20 shell companies to route and layer illicit funds. Financial analysis linked these entities to 176 cyber fraud complaints nationwide, with cumulative losses estimated at ₹180 crore.

Digital evidence suggested that Rajesh Khanna, who has since passed away in Noida, was used as a front or pawn to open accounts and mask the real controllers of the operation. The arrested accused also reportedly claimed connections to individuals involved in similar fraud cases in West Bengal, indicating possible inter-state or pan-India linkages.

Seizures and Ongoing Investigation

Police have seized two mobile phones and a laptop, which are currently under forensic examination. Bank accounts and digital devices are being analysed in coordination with the Indian Cyber Crime Coordination Centre to identify nationwide transaction linkages and additional beneficiaries.

Impact and Outlook

This case highlights the increasing use of shell companies and mule accounts as core infrastructure for large-scale cyber fraud operations. Authorities believe further arrests and asset seizures are likely as financial trails are traced across jurisdictions. The success of Operation Cy-Hawk signals a shift towards intelligence-led cyber policing, focusing on financial chokepoints rather than individual fraud incidents.