Introduction

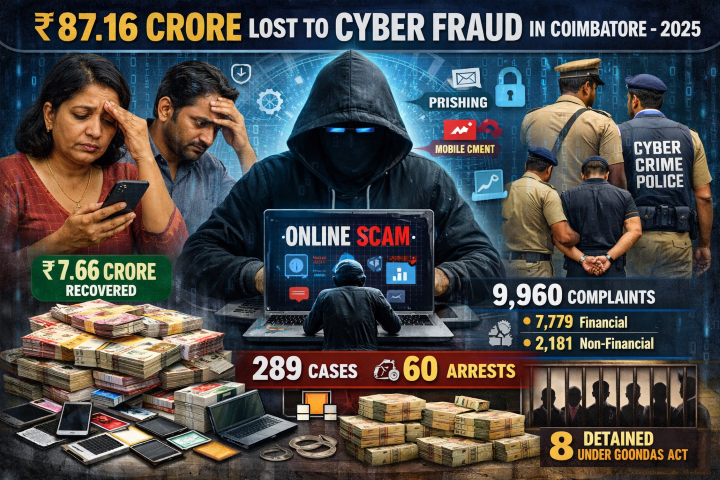

Cyber fraud continues to escalate as a serious financial and public safety threat in Coimbatore, with victims collectively losing ₹87.16 crore to online scams and digital cheating incidents during 2025. Official data highlights both the scale of financial losses and the growing burden on law enforcement to contain increasingly sophisticated cybercrime operations.

Background and Context

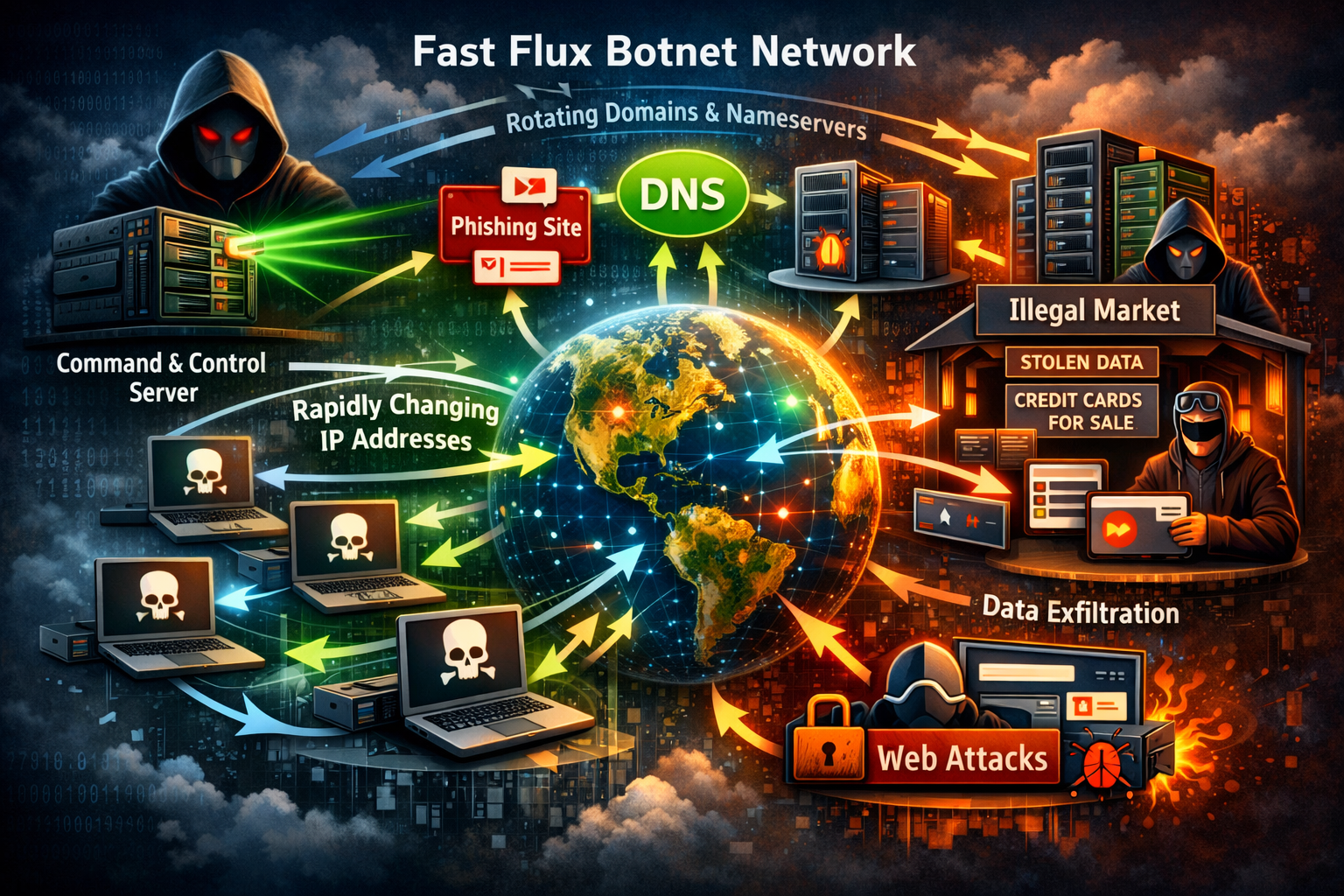

According to city police records, residents of Coimbatore were targeted through a wide range of online fraud schemes, including phishing, impersonation, investment scams, and digital payment fraud. While enforcement agencies have intensified their response, the volume of complaints indicates that cybercriminals continue to exploit digital adoption and low awareness among users.

Key Statistics at a Glance

- Total financial loss reported: ₹87.16 crore

- Amount recovered and refunded: ₹7.66 crore

- Total cybercrime complaints received: 9,960

- Financial complaints: 7,779

- Non financial complaints: 2,181

- Cases registered: 289

- Arrests made: 60 individuals

- Repeat and habitual offenders detained: 8 under preventive detention laws

Law Enforcement Action and Recovery Efforts

The cybercrime police unit has managed to trace and recover a portion of the defrauded funds in solved cases, returning ₹7.66 crore to victims. Authorities note that fund recovery depends heavily on early reporting and rapid coordination with banks and digital payment platforms.

Investigations during the year led to multiple arrests, with several accused linked to organized cybercrime networks operating across state boundaries. Police officials emphasized that preventive detention was used against repeat offenders involved in large scale digital fraud.

Broader Crackdown on Organized Crime

Beyond cyber fraud, city police also intensified action against narcotics and other illegal trades during 2025. Enforcement operations resulted in hundreds of arrests and large seizures of drugs, banned tobacco products, and prescription medications sold illegally. Several bank accounts linked to criminal proceeds were frozen as part of financial disruption measures.

Impact and Scope

The scale of cyber fraud losses reflects a significant economic and psychological impact on individuals and families. Many victims reported loss of life savings, delayed legal remedies, and challenges in recovering funds due to the speed at which money is laundered through mule accounts and digital wallets.

Expert Commentary

Cybersecurity experts warn that fraudsters are rapidly adapting to new technologies, including social engineering tactics and fake customer support operations. They stress that public awareness, digital hygiene, and timely reporting are critical to reducing losses.

Response and Mitigation

Authorities recommend the following measures for citizens:

- Report cyber fraud immediately to local cybercrime units or national cybercrime portals.

- Avoid sharing OTPs, PINs, or personal details with unknown callers or messages.

- Verify investment and loan offers through official channels.

- Enable transaction alerts and set daily limits on digital payments.

Outlook

With digital transactions continuing to grow, cybercrime is expected to remain a persistent threat. Law enforcement agencies are likely to expand inter state coordination, financial intelligence tracking, and public awareness campaigns to curb losses and improve recovery rates in the coming years.