Introduction

At the 56th Annual Meeting of the World Economic Forum (WEF) in Davos, Switzerland, State Bank of India (SBI) Chairman Challa Sreenivasulu Setty underscored the bank’s proactive engagement with frontier technologies including artificial intelligence (AI) and robust cybersecurity frameworks. Setty’s remarks, delivered on the sidelines of the global gathering, emphasize how digital transformation is reshaping financial services and institutional resilience.

Context at WEF 2026

The WEF Annual Meeting 2026, held from January 19–23 under the theme “A Spirit of Dialogue,” convened leaders from government, business, innovation and civil society to deliberate on pressing global priorities, with technology and economic growth among the top topics.

SBI’s Technology Priorities

Setty highlighted that SBI, one of India’s largest financial institutions serving over half a billion customers is aligning its strategy with emerging global technology trends, particularly:

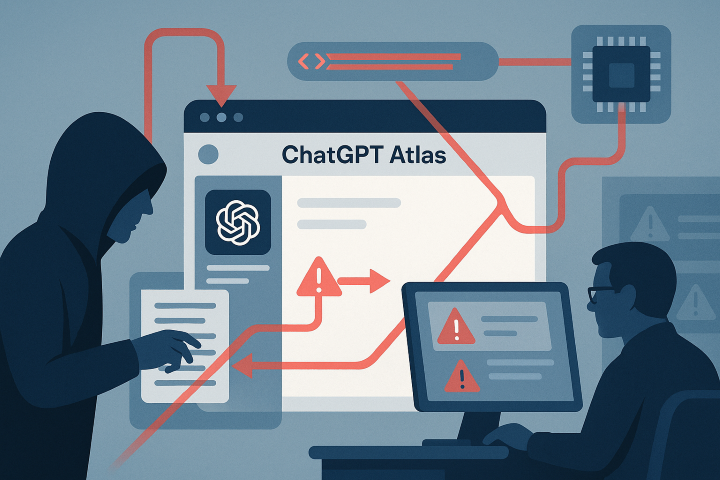

- AI Adoption at Scale: Transitioning beyond pilots into organization-wide AI integration for customer service, risk assessment, lending processes and operational efficiency.

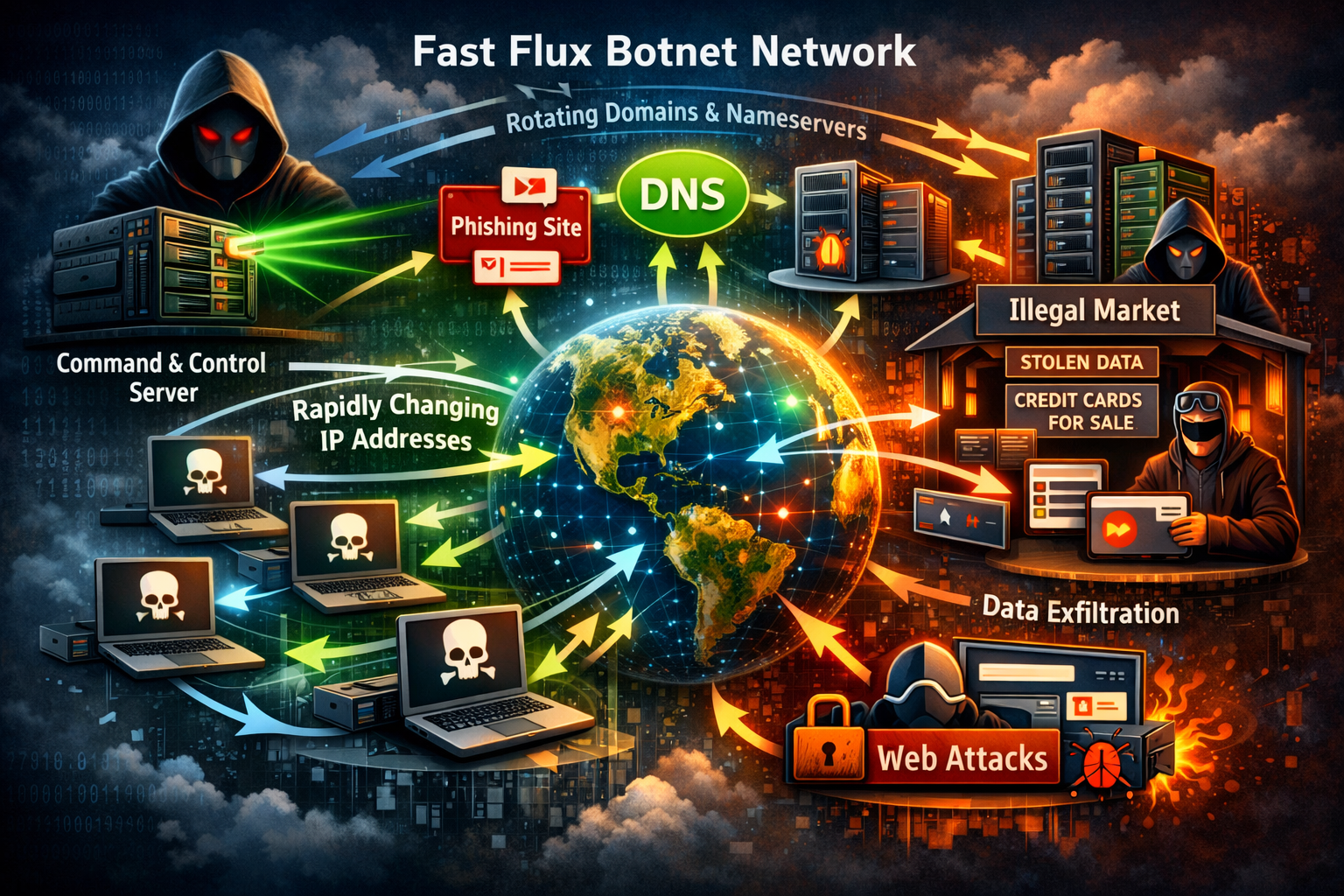

- Cybersecurity Resilience: Strengthening defenses against evolving cyber threats, which is increasingly crucial as digital channels become central to banking activities.

- Digital Transformation: Enhancing digital platforms such as SBI’s YONO app to expand services outside traditional branch networks.

Setty noted that conversations at Davos reflect broad industry focus on technological innovation and security resilience in financial services, alongside global economic and geopolitical uncertainties shaping business strategies.

Strategic Rationale & Industry Trends

The emphasis on AI and cybersecurity aligns with wider financial sector trends where digital innovation drives competitive advantage but also introduces new risk vectors. Financial institutions globally are adopting AI for automation and risk modeling, while cyber threats escalate in sophistication making security an enterprise imperative.

India’s Broader Narrative at Davos

Alongside SBI’s technology focus, Indian delegates highlighted the country’s rapid economic growth and technology ecosystem during the forum. Discussions included progress in renewable energy expansion, semiconductor production, and India’s rising stature in global economic rankings.

Outlook

SBI’s articulation of AI and cybersecurity as strategic pillars reflects the ongoing digital transformation within India’s banking sector. As financial services become more data-driven and interconnected, investments in secure AI deployment and cyber defenses will be key to fostering sustainable growth and customer trust.

Sources

- ANI News

SBI Chief highlights bank’s focus on emerging technologies like AI and cybersecurity at WEF 2026

https://www.aninews.in/news/world/europe/sbi-chief-highlights-banks-focus-on-emerging-technologies-like-ai-and-cybersecurity-at-the-world-economic-forum-2026-in-davos20260122085046/ - The Economic Times

SBI chief highlights bank’s focus on AI, cybersecurity at WEF 2026 in Davos

https://economictimes.indiatimes.com/industry/banking/finance/banking/sbi-chief-highlights-banks-focus-on-emerging-technologies-like-ai-and-cybersecurity-at-the-wef-2026-in-davos/articleshow/127100625.cms - Tribune India

AI, cybersecurity resilience key focus for banks: SBI Chief at Davos

https://www.tribuneindia.com/news/business/ai-cybersecurity-resilience-and-sustainable-financing-remain-key-focus-for-banks-sbi-chief-at-davos-576593