Introduction

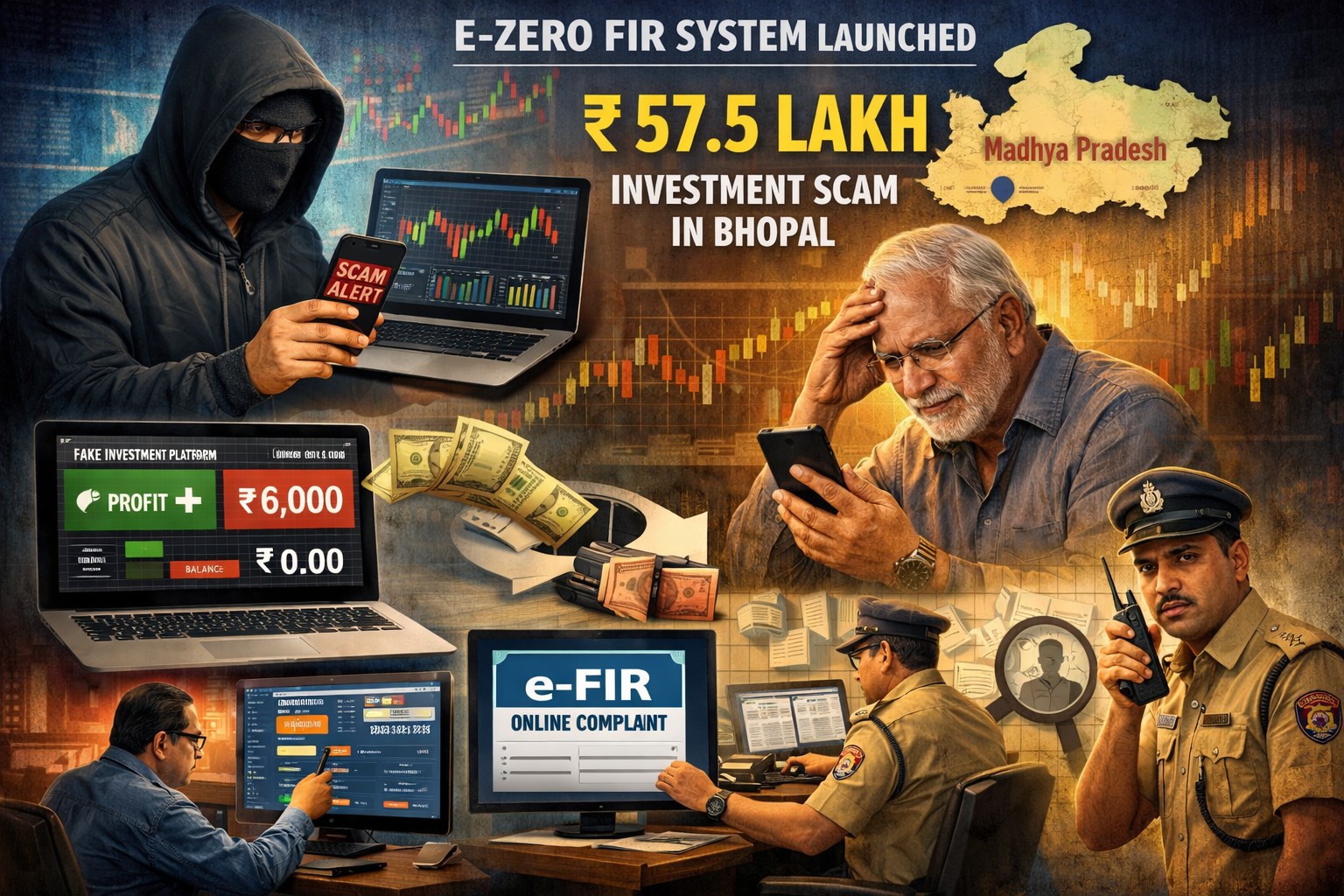

Madhya Pradesh is witnessing a sharp rise in reported cybercrime cases following the introduction of the e-Zero FIR system, a digital mechanism designed to simplify cyber fraud reporting. While the initiative has improved accessibility for victims, authorities say it has also revealed the true scale of online financial crimes operating across the state.

A recent ₹57.5 lakh investment fraud case registered in Bhopal highlights how cybercriminals are increasingly targeting even financially experienced individuals using sophisticated social engineering techniques.

Background and Context: e-Zero FIR System

The e-Zero FIR system was rolled out across Madhya Pradesh on December 25, 2025, allowing citizens to file preliminary cybercrime complaints online without visiting a police station. These digital complaints are reviewed by the State Cyber Crime Headquarters and forwarded to local police stations for conversion into regular FIRs.

Since its launch, more than 350 e-Zero FIR complaints related to cyber fraud have been routed to police units across the state, indicating both higher awareness among citizens and a growing volume of cyber-enabled financial crimes.

Case Overview: ₹57.5 Lakh Investment Scam

The latest case was registered at Misrod police station and involves a 61-year-old retired bank manager who fell victim to a fraudulent online investment scheme.

According to police officials, the victim was searching online for stock market investment opportunities when he came across contact details of a firm claiming associations with a private bank. The representation appeared legitimate but was later confirmed to be fraudulent.

Timeline of Events

- December 2, 2025: The victim opened an online account with the fake investment firm.

- Around December 10, 2025: He received calls from unknown numbers urging him to invest immediately, promising high and assured returns.

- December 12, 2025: First transfer of ₹50,000 was made via NEFT.

- December 13, 2025: A manipulated link showed fabricated profits of ₹6,000, creating false confidence.

- December 17, 2025 – January 6, 2026: The victim transferred ₹57.5 lakh in nearly six transactions to multiple bank accounts provided by the fraudsters.

- Post January 6, 2026: Fraudsters demanded an additional ₹43.87 lakh, citing IPO allotments. When the victim refused, threats followed.

- Discovery: The investment dashboard balance dropped to zero, and all contact numbers became unreachable.

Modus Operandi and Technical Deception

Investigators revealed that the accused used:

- Fake trading platforms with manipulated dashboards

- Artificial profit indicators to build trust

- Multiple rotating mobile numbers to avoid tracing

- Bank accounts opened using compromised or mule identities

The scam relied heavily on psychological pressure, urgency, and the victim’s financial familiarity to bypass suspicion.

Reporting and Police Action

After realizing the fraud, the victim immediately contacted the cyber helpline, resulting in the registration of an e-Zero FIR. The complaint was subsequently transferred to Misrod police station, where a formal FIR was registered against unknown accused.

Police teams are currently:

- Analysing mobile numbers used by the suspects

- Tracking bank accounts and transaction trails

- Examining digital footprints and IP logs

Officials confirmed this is the second major investment-related cyber fraud reported in Bhopal within three days.

Impact and Growing Threat Landscape

Authorities noted that cybercriminals are no longer targeting only inexperienced users. Retired professionals, investors, and individuals with prior banking or financial knowledge are increasingly being lured through well-crafted scams.

The surge in complaints underscores a broader escalation of cyber fraud activity across Madhya Pradesh, particularly involving fake investment platforms and IPO scams.

Response and Mitigation Advisory

Police have issued a strong advisory urging citizens to:

- Verify company registration details and regulatory approvals

- Avoid unsolicited investment calls or messages

- Refrain from clicking unknown links or dashboards

- Never rely solely on phone-based assurances

Early reporting through the cyber helpline or local police stations significantly improves the chances of fund tracing and recovery.

Expert Commentary

Cybercrime officials emphasized that while the e-Zero FIR system has streamlined reporting, prevention remains critical. Digital vigilance, financial literacy, and timely action are key to countering modern cyber fraud networks.

Outlook

With cybercriminals continuously evolving their tactics, law enforcement agencies are strengthening digital forensics and inter-bank coordination. Investigators remain optimistic that transaction analysis and technical evidence will lead to the identification and arrest of those behind the scam.

The case serves as a reminder that in the digital economy, trust must always be verified before money is transferred.Introduction

Madhya Pradesh is witnessing a sharp rise in reported cybercrime cases following the introduction of the e-Zero FIR system, a digital mechanism designed to simplify cyber fraud reporting. While the initiative has improved accessibility for victims, authorities say it has also revealed the true scale of online financial crimes operating across the state.

A recent ₹57.5 lakh investment fraud case registered in Bhopal highlights how cybercriminals are increasingly targeting even financially experienced individuals using sophisticated social engineering techniques.

Background and Context: e-Zero FIR System

The e-Zero FIR system was rolled out across Madhya Pradesh on December 25, 2025, allowing citizens to file preliminary cybercrime complaints online without visiting a police station. These digital complaints are reviewed by the State Cyber Crime Headquarters and forwarded to local police stations for conversion into regular FIRs.

Since its launch, more than 350 e-Zero FIR complaints related to cyber fraud have been routed to police units across the state, indicating both higher awareness among citizens and a growing volume of cyber-enabled financial crimes.

Case Overview: ₹57.5 Lakh Investment Scam

The latest case was registered at Misrod police station and involves a 61-year-old retired bank manager who fell victim to a fraudulent online investment scheme.

According to police officials, the victim was searching online for stock market investment opportunities when he came across contact details of a firm claiming associations with a private bank. The representation appeared legitimate but was later confirmed to be fraudulent.

Timeline of Events

- December 2, 2025: The victim opened an online account with the fake investment firm.

- Around December 10, 2025: He received calls from unknown numbers urging him to invest immediately, promising high and assured returns.

- December 12, 2025: First transfer of ₹50,000 was made via NEFT.

- December 13, 2025: A manipulated link showed fabricated profits of ₹6,000, creating false confidence.

- December 17, 2025 – January 6, 2026: The victim transferred ₹57.5 lakh in nearly six transactions to multiple bank accounts provided by the fraudsters.

- Post January 6, 2026: Fraudsters demanded an additional ₹43.87 lakh, citing IPO allotments. When the victim refused, threats followed.

- Discovery: The investment dashboard balance dropped to zero, and all contact numbers became unreachable.

Modus Operandi and Technical Deception

Investigators revealed that the accused used:

- Fake trading platforms with manipulated dashboards

- Artificial profit indicators to build trust

- Multiple rotating mobile numbers to avoid tracing

- Bank accounts opened using compromised or mule identities

The scam relied heavily on psychological pressure, urgency, and the victim’s financial familiarity to bypass suspicion.

Reporting and Police Action

After realizing the fraud, the victim immediately contacted the cyber helpline, resulting in the registration of an e-Zero FIR. The complaint was subsequently transferred to Misrod police station, where a formal FIR was registered against unknown accused.

Police teams are currently:

- Analysing mobile numbers used by the suspects

- Tracking bank accounts and transaction trails

- Examining digital footprints and IP logs

Officials confirmed this is the second major investment-related cyber fraud reported in Bhopal within three days.

Impact and Growing Threat Landscape

Authorities noted that cybercriminals are no longer targeting only inexperienced users. Retired professionals, investors, and individuals with prior banking or financial knowledge are increasingly being lured through well-crafted scams.

The surge in complaints underscores a broader escalation of cyber fraud activity across Madhya Pradesh, particularly involving fake investment platforms and IPO scams.

Response and Mitigation Advisory

Police have issued a strong advisory urging citizens to:

- Verify company registration details and regulatory approvals

- Avoid unsolicited investment calls or messages

- Refrain from clicking unknown links or dashboards

- Never rely solely on phone-based assurances

Early reporting through the cyber helpline or local police stations significantly improves the chances of fund tracing and recovery.

Expert Commentary

Cybercrime officials emphasized that while the e-Zero FIR system has streamlined reporting, prevention remains critical. Digital vigilance, financial literacy, and timely action are key to countering modern cyber fraud networks.

Outlook

With cybercriminals continuously evolving their tactics, law enforcement agencies are strengthening digital forensics and inter-bank coordination. Investigators remain optimistic that transaction analysis and technical evidence will lead to the identification and arrest of those behind the scam.

The case serves as a reminder that in the digital economy, trust must always be verified before money is transferred.

Sources

- Madhya Pradesh Police – Cyber Crime Wing

https://cybercrime.mppolice.gov.in - National Cyber Crime Reporting Portal (Cyber Helpline 1930)

https://www.cybercrime.gov.in - Indian Cyber Crime Coordination Centre (I4C), Ministry of Home Affairs

https://www.i4c.mha.gov.in