Introduction

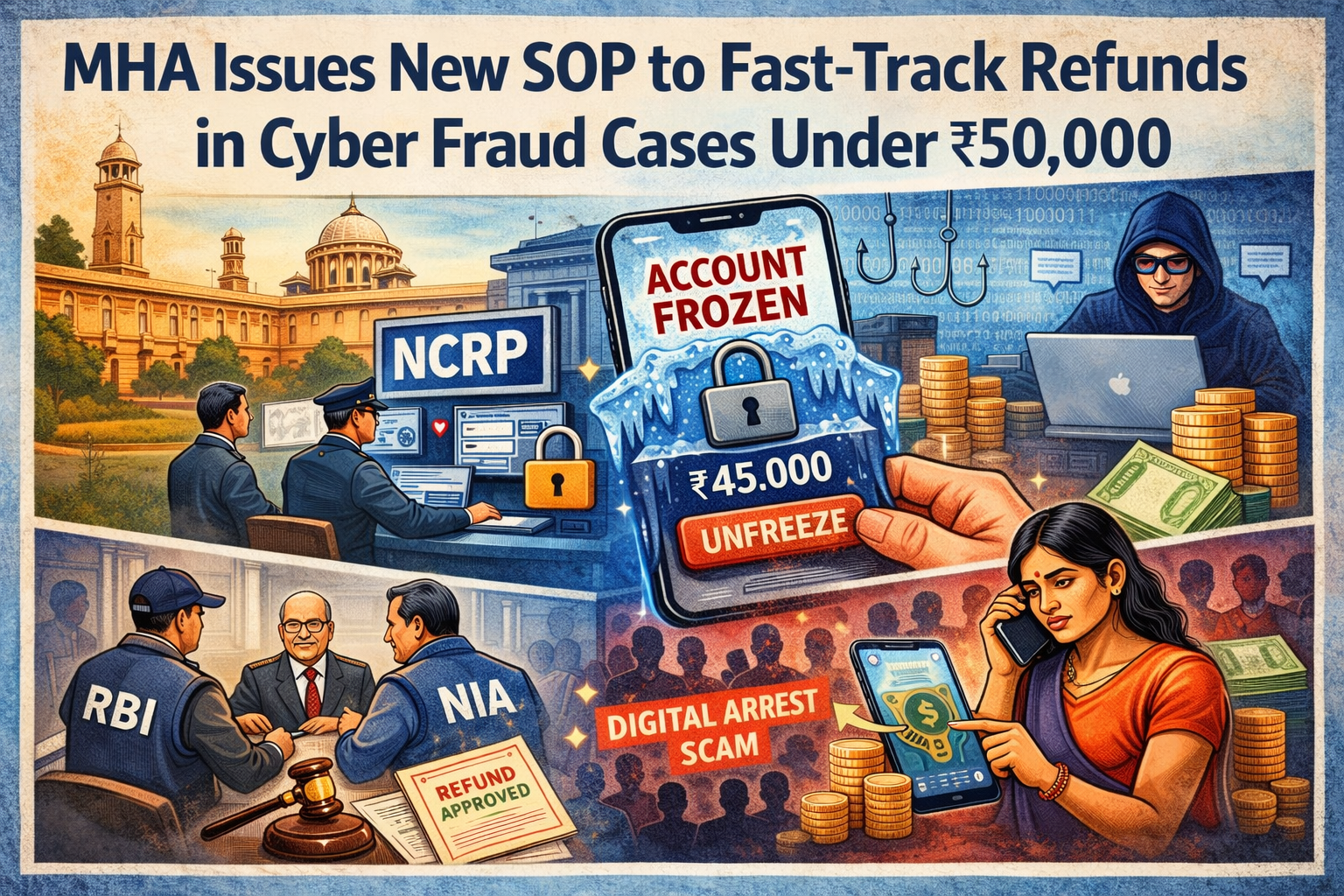

In a significant relief for cyber fraud victims, the Ministry of Home Affairs (MHA) has approved a new Standard Operating Procedure aimed at accelerating refunds in low-value cyber fraud cases. The move addresses long-standing complaints around prolonged account freezes and delayed restitution for victims of online financial crimes.

Background and Context

The SOP has been notified for the National Cybercrime Reporting Portal’s Cyber Financial Crime Reporting and Management System. As reported by The Indian Express, the framework introduces uniform, time-bound procedures for financial institutions once a transaction is flagged through a cybercrime complaint.

This development comes amid persistently high cyber fraud losses, underscoring the need for faster grievance redressal and victim-centric reforms.

Key Provisions of the New SOP

- No court order required for small-value cases:

For frauds involving amounts below ₹50,000, refunds can now be processed without waiting for a court or restoration order. - 90-day deadline for lifting freezes:

In the absence of any judicial direction, banks must lift freezes on disputed amounts within 90 days. - Standardised process for intermediaries:

The SOP applies uniformly to banks, payment aggregators, NBFCs, e-commerce platforms, stock trading apps, and mutual fund houses. - Three-tier grievance redressal mechanism:

A structured escalation framework has been introduced to ensure timely resolution of complaints where accounts or funds are unnecessarily frozen.

Scale of the Cyber Fraud Problem

Data compiled by the Indian Cyber Crime Coordination Centre (I4C) highlights the severity of the issue:

- 2025: ₹19,812.96 crore lost across 2,177,524 complaints

- 2024: ₹22,849.49 crore lost across 1,918,852 complaints

Over the last six years, total losses from fraud and cheating cases have exceeded ₹52,976 crore. Earlier years saw losses of ₹7,463.2 crore in 2023, ₹2,290.23 crore in 2022, ₹551.65 crore in 2021, and ₹8.56 crore in 2020, as per NCRP data.

High-Level Panel on “Digital Arrest” Scams

Following directions from the Supreme Court of India in a suo motu matter on so-called digital arrest scams, the MHA has constituted a high-level inter-departmental committee.

The panel is chaired by the Special Secretary for Internal Security, MHA, and includes senior officials from MeitY, DoT, the Department of Financial Services, the Reserve Bank of India, the Central Bureau of Investigation, the National Investigation Agency, Delhi Police, and the I4C. The I4C CEO serves as Member-Secretary.

Mandate and Early Recommendations

The committee is tasked with:

- Reviewing operational challenges faced by enforcement agencies

- Examining court directions and amicus curiae recommendations

- Identifying regulatory and legal gaps

- Proposing corrective and preventive measures

During its first meeting on December 29, the CBI proposed a monetary threshold model, where high-value cases would be handled centrally, while lower-value cases would be managed by State or Union Territory agencies with MHA support.

The RBI informed the court that it has issued advisories to banks on deploying AI-based fraud detection tools and is close to finalizing an SOP for freezing accounts linked to suspicious transactions.

Regulatory Gaps and Victim Compensation

The Ministry of Electronics and Information Technology highlighted the need to strengthen adjudication mechanisms under Section 46 of the Information Technology Act, 2000. Meanwhile, the Department of Telecommunications said draft rules under the Telecommunications Act, 2023, are under stakeholder consultation to curb issues like negligent SIM issuance.

A key consensus emerged around victim compensation. The panel agreed that accountability must be fixed where losses arise from negligence or service deficiencies by banks, telecom providers, or other regulated entities. Victims, it noted, should not suffer due to systemic failures.

Outlook

The MHA has sought additional time from the Supreme Court to allow the committee to deliberate further and submit comprehensive inputs. The matter is scheduled for its next hearing on January 20.

The newly approved SOP marks a critical shift towards faster relief for cyber fraud victims and signals a broader regulatory push to balance enforcement needs with consumer protection in India’s rapidly evolving digital economy.

Sources

- The Indian Express: https://indianexpress.com

- Live Law: https://www.livelaw.in

- Ministry of Home Affairs (MHA), Government of India: https://www.mha.gov.in

- National Cybercrime Reporting Portal (NCRP): https://cybercrime.gov.in